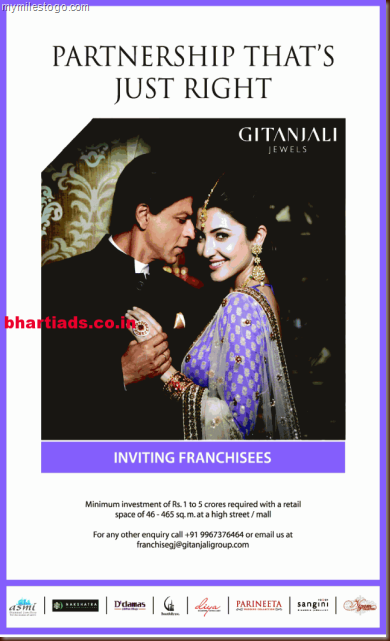

Franchising has been around for long. Many global brands such as Adidas, Benetton, Levis, Subway and a lot more have grown globally due to their extensive franchisee network. Even in India, Madura Garments (which owns brands such as Peter England, Louis Philippe, Van Heusen), Arvind Mills (Lee, Wrangler and Arrow), Nilgiris (a chain of Supermarkets), Gitanjali Limited (which retails brands such as Asmi, Gili, D’Damas, Lucera, etc.) Crossword Book stores, Barista (Café chain) and many other Retailers have grown their businesses through successful Franchisee Partnerships. Franchising offers a quick scope of expansion for the Retailer while the investment is incurred by the Franchisee. Many first timers and wannabe Entrepreneurs choose the path of Franchising because it is an easier model to crack – the brand (is usually) established and has equity in the market, which pulls footfalls in to the stores. In case the brand is relatively new, then the Franchise fee (usually a one-time fee paid by the Franchisor to the Franchisee) is low, keeping his / her investments within reach. Kaatizone, an Indian QSR chain with a presence largely in South India is on an expansion spree through Franchising. Mr. Kiran Nadkarni, CEO, Kaatizone told in an interview recently. “Franchising has helped us in two major ways: We have been able to generate momentum in expansion quickly. Secondly, the local entrepreneurial talent has helped manage the store operations and brand experience better. Since we are planning to set up a large number of stores, franchising is the best strategy for growth.” Kaatizone has 19 franchises in six cities now and is planning to expand across the country.

The gestation period for recovery of investment can vary from 6 months to 3 years, depending on the location of the store (Malls, High Streets, Corporate locations,etc.) product category, and Brand identity and recognition. Investments could vary from Rs. 5 lakhs to Rs. 2 Crores, depending on the Brand. Some Retailers charge a one-time Franchise Fee and others charge monthly/annual commission on Sales in addition.

Advantages of Franchising

Scalability of Business

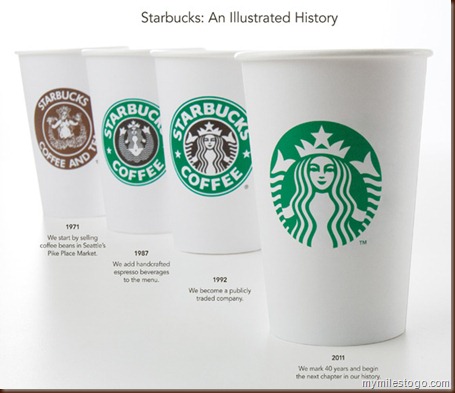

The Franchisor would be able to scale up instantly by going through the Franchise model. The prospective Franchisees could be spread across the country and hence the business could be expanded quite fast. This is one of the most important reasons that Retailers choose to go the Franchising way.

Immediate availability of capital

The Franchisee brings in the additional capital that is required to invest and operate the business which is a very important factor for the Franchisor.

Day to-day Operations

Usually, the set-up costs, which are substantial are borne by the Franchisee. He also bears running costs such as daily operational expenses (manpower, electricity, housekeeping, interest on capital, depreciation, etc.)

Drawbacks of Franchising

Customer Touch-points

One of the biggest drawbacks in Franchising is that the Retailer usually loses touch with the customers. The front-end is managed by the Franchisee and hence the Brand doesn’t have much role to play in the Customer Engagement as such.

Loss of Operational Control

The daily operations are managed by the Franchisee. Although there are parameters which need to be followed, there are occasions when the Franchisee takes things under his control which could be potential threats in terms of running the business.

Loss of Focus

Once a Franchisee believes in the model, he / she expand their business across various brands and categories. Therefore, the required focus on the business may dwindle over a period of time. It is quite unlikely that the Franchisee would spend the same amount of time and effort on businesses that don’t yield similar returns.

FDI in Retail has already opened up for Single Brand Retail and the country is eagerly watching the Government’s steps towards their decision on allowing FDI in Multi-Brand Retailing. This is indeed a good time for individuals and entrepreneurs in the making to take their first steps towards Organized Retail through a Franchise Opportunity.

Best of Luck.